What is an ETF?

An exchange-traded fund (ETF) combines the features of mutual funds and stocks. Similar to mutual funds, ETFs are a diversified mix of stocks, bonds, or other assets. ETFs are funds that trade like individual stocks on major exchanges, similar to securities of publicly held companies. As a result, ETFs can be bought or sold at any moment during market hours.

The Active Difference

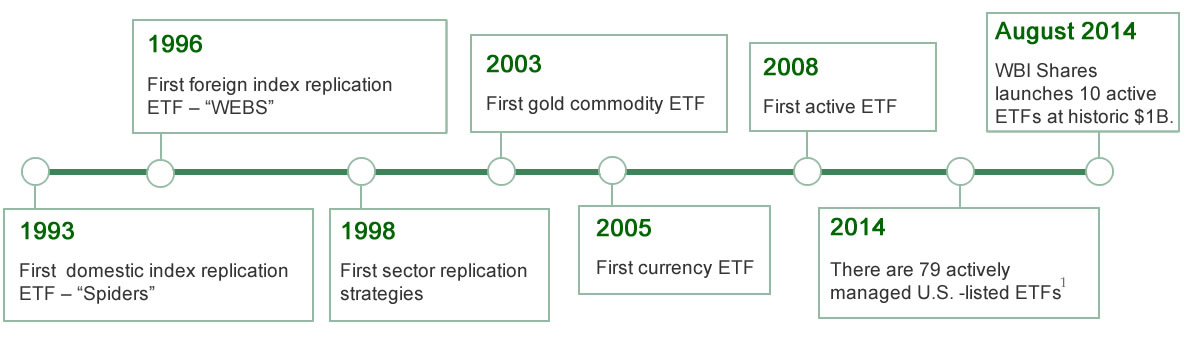

While most ETFs are index based, meaning the fund’s holdings seek to replicate the holdings of a specific index, only a handful of ETFs are actively managed. Actively managed ETFs are funds whose shares are traded during the day on stock exchanges. However, active ETFs do not seek to replicate the holdings of an underlying index. Instead, their holdings are chosen by a professional investment manager.

WBI Shares Actively Managed ETFs

WBI Shares has partnered with WBI Investments to sub-advise a series of actively managed ETFs. While many investment managers attempt to perform well relative to a fluctuating market index or benchmark, the risk-managed investment approach used for each fund by the sub-advisor attempts to provide consistent, attractive returns net of expenses with potentially less volatility and risk to capital than traditional approaches, whatever market conditions may be. Under normal market conditions, each fund will invest according to its principal investment strategies as noted above. A fund, however, may temporarily depart from its principal investment strategies by making short-term investments in cash, cash equivalents, and high-quality, short-term debt securities and money market instruments for temporary defensive purposes.

Active ETFs vs. Passive ETFs

| Active ETFs | Passive ETFs |

| Active | Passive |

| Moderate Cost | Low Cost |

| Intraday Pricing & Liquidity | Intraday Pricing & Liquidity |

| Average Tax-Efficiency | Above Average Tax-Efficiency |

| Selective Diversification | Broad Diversification |

| Asymmetrical Performance | Symmetrical Performance |

Symmetrical Performance is performance that correlates to the market's ups and downs. It is measured by standard metrics such as rate of return, standard deviation, beta, and alpha.

Asymmetrical Performance is performance that has a non-symmetrical relationship to the market's ups and downs. Source: WBI, 2014.

An investment in the Funds is subject to investment risk, including the possible loss of principal amount invested. Please read the prospectus carefully prior to investing.